Retrofit Incentives & Tax Benefits

Maximize Your Savings with Solar Incentives & Tax Benefits

Switching to solar energy is not just an environmentally responsible decision—it’s also a financially smart investment. The Canadian government, along with provincial authorities, offers various incentives, grants, and tax benefits to help businesses in Ontario offset the upfront cost of solar retrofitting.

At Bendygo Solar, we help our clients navigate these financial opportunities so they can take full advantage of available funding options. From federal tax credits to provincial rebates, we ensure you get the maximum return on your solar investment.

Solar Retrofit Incentive Program

Save on Energy: Get Incentives for Solar Power!

Are you a business owner looking to reduce energy costs and become more sustainable? The Save on Energy Retrofit Program now offers cash incentives for installing solar photovoltaic (PV) systems to help you generate your own electricity and reduce reliance on the grid.

If you’re looking to adopt solar energy but your building wasn’t originally designed for it, a retrofit solar system from Bendygo Solar could be the perfect solution for you. Let us help you transform your business’s energy use and contribute to a greener future.

Incentives Available

There are two categories of solar incentives based on system size:

- Micro Generation (≤ 10 kW-DC)

- $1,000 per kW-DC incentive for systems up to 10 kW-DC.

- Small/Medium Generation (>10 kW-AC up to 1 MW-AC)

- $860 per kW-AC incentive for systems between 10 kW-AC and 1 MW-AC.

💡 Important: Incentives cover up to 50% of eligible project costs, including materials, inverters, racking, and installation.

Program Guidelines

- Load Displacement Only: This program is designed for businesses that use the solar power they generate. You cannot sell excess electricity back to the grid (no net-metering or compensation agreements).

- Location Requirements: The solar PV system must be installed on:

- Rooftops

- Parking canopies

- Wall-mounted structures

- Compliance Requirements:

- Must meet Ontario Building Code, Electrical Safety Code, and other regulatory standards.

- Must be approved by your Local Distribution Company (LDC).

- Approval Process:

- A Retrofit application must be pre-approved before purchasing solar equipment.

- Starting installation before approval could make you ineligible for incentives.

- No Clean Energy Credits (CEC): Solar PV systems funded by this program cannot register for Ontario’s Clean Energy Credit program.

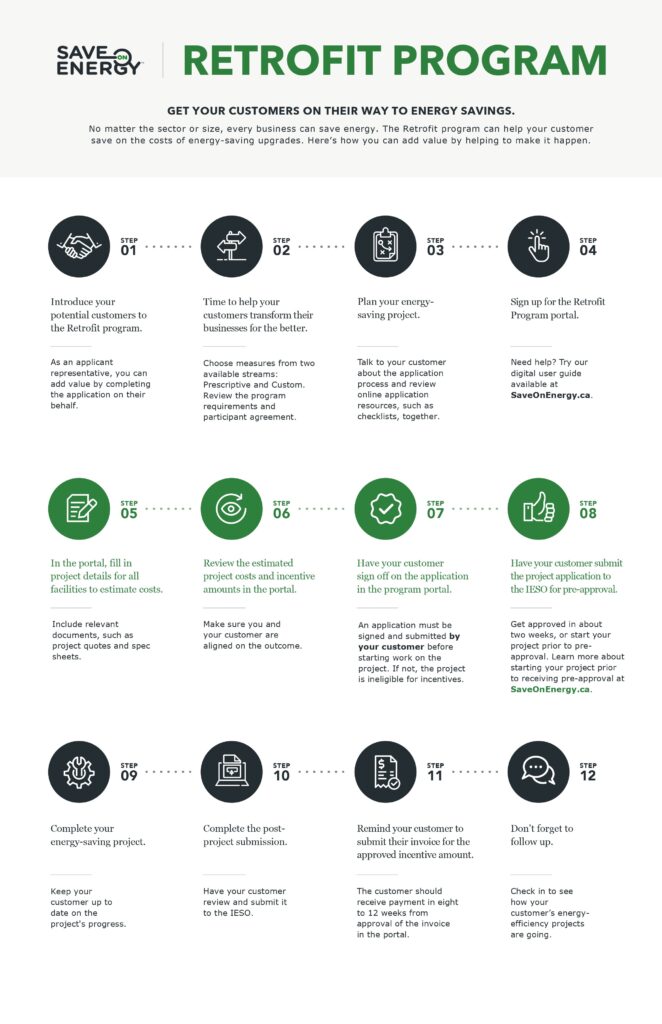

How to Apply

- Check Your Eligibility: Ensure your business qualifies under the Retrofit Program requirements.

- Consult Your LDC: Work with your local utility provider to determine technical requirements.

- Submit a Retrofit Application: Get pre-approval before purchasing any solar equipment.

- Install Your System: After approval, complete the installation with a certified contractor.

- Claim Your Incentive: Submit final documents to receive your incentive payment.

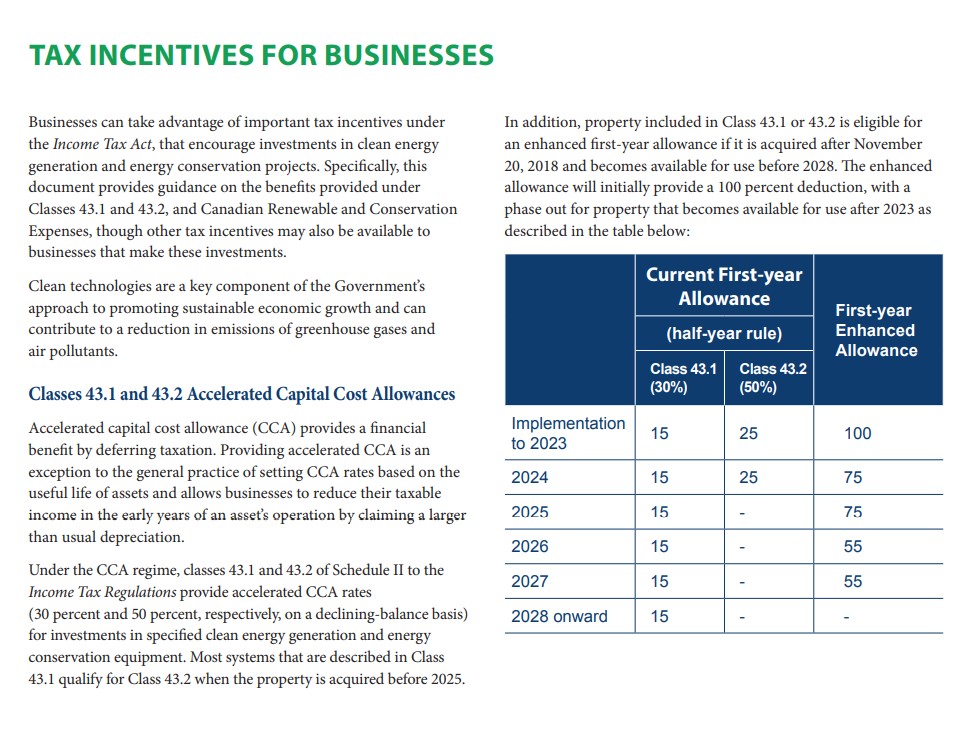

SOLAR TAX INCENTIVES FOR BUSINESSES

Canadian Renewable and Conservation Expenses

If the majority of the tangible property in a project is eligible for inclusion in Class 43.1 or 43.2, certain

intangible project start-up expenses (e.g. engineering and design work and feasibility studies) may also be

eligible as Canadian Renewable and Conservation Expenses (CRCE). These expenses may be deducted in

full in the year incurred, carried forward indenitely for use in future years, or transferred to investors using

ow-through share.

For More Information

Natural Resources Canada’s Technical Guide to Class 43.1 and 43.2 contains technical information on the

components of systems and schematics of typical systems, the capital costs of which may be included in

Class 43.1 or 43.2. Similarly, information on project development costs that may qualify as CRCE may be

found in the Technical Guide to Canadian Renewable and Conservation Expenses (CRCE). Both

publications can be accessed at the following link: nrcan.gc.ca/energy/efciency/industry/nancialassistance/5147

FAQ

What is The Save on Energy Retrofit program?

The Save on Energy Retrofit program is offering a new incentive for distributed energy resources (DERs) for

businesses. The incentive is for the installation of solar photovoltaic (PV) systems for load displacement

purposes. There are two categories of incentives: Micro Generation – The incentive is $1,000/kW-DC for

systems that are less than or equal to 10 kW-DC (direct current) Small/Medium Generation – The incentive

is $860/kW-AC for systems that are greater than 10kW-AC up to 1 MW-AC (alter

Why is net metering not allowed?

In the directive issued to the IESO by the Minister of Energy and Electrication, the denition of electricity

demand side management (eDSM) excludes measures promoted through a different program or initiative

undertaken by the Government of Ontario or the IESO. This means that participants of the Retrot program

are not eligible for net metering agreements

Is third-party Financing or ownership of the solar PV equipment allowed?

Participants must follow the Retrot program requirements. The incentive will only be paid to the

participant, which must be the owner or operator of the facility on which the solar PV system is installed.

The solar PV system itself cannot be considered the facility as dened in the Retrot program

requirements.

How big can the solar panel array be?

For a load displacement arrangement with no net-metering or compensation for excess generation, the

size of the solar PV array should ideally match the facility’s typical energy consumption prole. This

ensures maximizing the use of solar power generated without frequently producing more than can be

used.

Are ground-mounted installations eligible for the incentive?

The incentive for solar PV systems is limited to rooftops, parking canopies or wall-mounted installations.

Is there a limit on the solar DER incentive?

As per the Retrofit Program Requirements, incentives are limited at up to 50% of the eligible project costs,

including eligible material costs for solar PV systems, inverter technologies, racking system, and

installation costs. In addition, while larger system sizes are eligible to apply, the incentives available for

small to medium generation solar PV systems is capped at an alternating current capacity size of up to 1

MW-AC.

For solar PV projects do the program requirements aim to prevent grid injection or the LDC installing a bi-directional meter?

Typically, no. However, the IESO expects the Local Distribution Company (LDC) to manage the technical

connection requirements. Please consult the relevant LDC to determine your system’s technical

requirements.

Why is the size of solar PV generated output limited for the two categories being offered (Micro generation and small/medium generation)?

The incentives offered for solar PVs are based on the size of the system capacity for the PV and should

accommodate the rooftop sizes of most businesses. The incentives are capped at a maximum system

capacity size for both microgeneration and small to medium generation solar PV systems to manage the

program budget and connection availability for solar PV systems.

Are program participates able to take advantage of net metering for solar PV systems that receive a retrofit incentive in the future?

No, participants that receive a Retrofit incentive for a solar PV system are required to operate the system

for load displacement purposes for the life of the system, where the Retrot ParticipantAgreement

prevents the participant from entering into a net-metering agreement or any other compensation

agreement for electricity that is generated and injected into the grid by the solar PV system.

Are there any equipment specication/requirements for the funding eligibility?

The solar PV system must comply with the Local Distribution Company’s assessment requirements, and all

government rules and regulations, including but not limited to the provincial and local building codes, the

Ontario electrical safety codes, and applicableANSI, CSA, IEC and UL standards, including but not limited to

IEEE 1547 and UL 1741.

Are participates eligible to register for the Ontario Clean Energy Credit program?

Retrot program funded solar PV generators are NOT eligible to register for the Ontario Clean Energy Credit

program because the registry excludes behind-the-meter generators.

Have Questions? Call Us 1855-204-4005

Contact Bendygo Solar for a free consultation, and let us design the perfect solar solution for your needs.